|

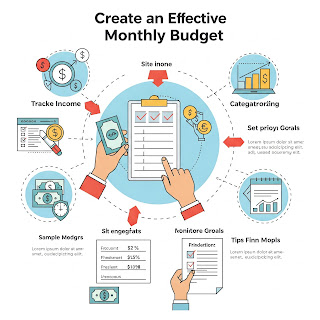

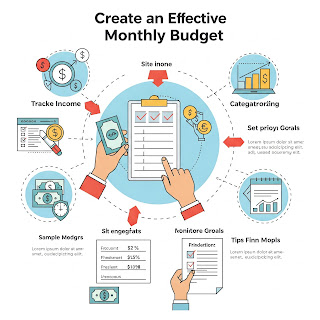

(Creating an Effective Monthly Budget)

|

Feeling like your money slips

through your fingers every month? You're not alone. Many people struggle to

manage their finances effectively. The good news is that creating and sticking

to a monthly budget can be a game-changer, putting you in control of your money

and paving the way for a more secure financial future. A well-crafted budget

isn't about restriction; it's about intentional spending and making your money

work for you. Let's dive into a step-by-step guide on how to create an

effective monthly budget that aligns with your financial goals.

Why Budget? The Benefits of

Financial Awareness

Before we jump into the

"how," let's understand the "why." Creating a monthly

budget offers numerous benefits:

- Gain Control: Know exactly where your money

is going instead of wondering at the end of the month.

- Identify Spending Leaks: Pinpoint areas

where you might be overspending or making unnecessary purchases.

- Achieve Financial Goals: Allocate funds

specifically for savings, debt repayment, or future investments.

- Reduce Financial Stress: Having a plan can

alleviate anxiety about money and provide a sense of security.

- Prepare for Unexpected Expenses: Build in

buffers or emergency funds to handle unforeseen costs.

- Make Informed Financial Decisions:

Understand your financial situation better, leading to smarter choices

about spending and saving.

Step-by-Step Guide to Creating

Your Effective Monthly Budget:

- Track Your Current Income:

- Start by calculating your total monthly income

after taxes. Include all sources of income, such as salary, freelance

work, or investment returns. Be realistic and consistent.

- Track Your Current Expenses:

- This is a crucial step. For at least a month (or

ideally longer), meticulously track every single expense. Use a notebook,

spreadsheet, budgeting app, or bank statements. Categorize your spending

(e.g., housing, food, transportation, entertainment, debt payments).

- Be honest with yourself – even those small daily

coffee purchases add up!

- Categorize Your Expenses:

- Once you have a good overview of your spending,

categorize your expenses into two main types:

- Fixed Expenses: These are recurring

expenses that are generally the same amount each month (e.g.,

rent/mortgage, loan payments, insurance premiums, subscriptions).

- Variable Expenses: These are expenses

that fluctuate from month to month (e.g., groceries, utilities,

entertainment, dining out, clothing).

- Set Your Financial Goals:

- What do you want to achieve with your money?

Define your short-term, medium-term, and long-term financial goals.

Examples include saving for a down payment, paying off credit card debt,

building an emergency fund, or investing for retirement.

- Having clear goals will help you prioritize your

spending and allocate your funds effectively.

- Create Your Budget Plan:

- Now it's time to allocate your income to your

expenses and savings goals. Use the information you gathered in steps

1-4.

- The 50/30/20 Rule: A popular guideline

suggests allocating 50% of your after-tax income to needs (fixed expenses

and essential variable expenses like groceries), 30% to wants

(non-essential spending like entertainment and dining out), and 20% to

savings and debt repayment. This can be a good starting point, but adjust

it based on your individual circumstances and goals.

- Zero-Based Budgeting: Another effective

method is to allocate every dollar of your income to a specific category,

so your income minus your expenses equals zero. This ensures that all

your money is accounted for.

- Prioritize Your Spending:

- Based on your financial goals, prioritize your

spending. Ensure that essential needs and debt payments are covered

first. Then, allocate funds to your savings goals before discretionary

spending.

- Track Your Spending Regularly:

- Creating a budget is only half the battle. You

need to track your actual spending against your budget throughout the

month. Regularly review your expenses to see if you're staying on track.

Budgeting apps can be incredibly helpful for this.

- Review and Adjust Your Budget Regularly:

- Your financial situation and goals may change over

time. Review your budget at least monthly (or more frequently if needed)

and make adjustments as necessary. Life events, changes in income, or new

financial goals might require modifications to your plan.

- Be Flexible and Patient:

- Don't get discouraged if you don't stick to your

budget perfectly at first. Budgeting is a learning process. Be flexible,

identify what's not working, and make adjustments. The key is consistency

and continuous effort.

Tools to Help You Budget:

Numerous tools can assist you in

creating and managing your budget:

- Spreadsheets (e.g., Google Sheets, Microsoft

Excel): Offer flexibility and customization.

- Budgeting Apps (e.g., Mint, YNAB (You Need A

Budget), Personal Capital): Often link to your bank accounts and

automatically track spending.

- Notebooks and Planners: A low-tech but

effective way to manually track your finances.

Choose the method that best suits

your preferences and lifestyle.

Conclusion:

Creating an effective monthly

budget is a powerful step towards gaining control of your finances and

achieving your financial goals. It requires awareness, planning, and consistent

effort, but the rewards – reduced stress, increased savings, and a clearer path

to your financial future – are well worth it. By following these steps and

utilizing the tools available, you can take charge of your money and build a

more secure and fulfilling financial life.

What are your biggest budgeting

challenges? What tips have you found most helpful in managing your monthly

finances? Share your experiences and advice in the comments below! |

Post a Comment